Oct 20, 2023

Rite Aid, a pharmacy chain, has filed for Chapter 11 bankruptcy protection due to significant debt and opioid-related litigation. The company received a commitment of $3.45 billion from creditors and lenders to support its operations and financial restructuring. The bankruptcy is expected to result in the closure of hundreds of Rite Aid stores. The filing will address the opioid-related lawsuits and help the company optimize its store footprint, with plans to close underperforming stores. Jeffrey Stein has been appointed as the new CEO and chief restructuring officer. Rite Aid has been struggling financially, with ongoing losses and a substantial debt burden.

Oct 19, 2023

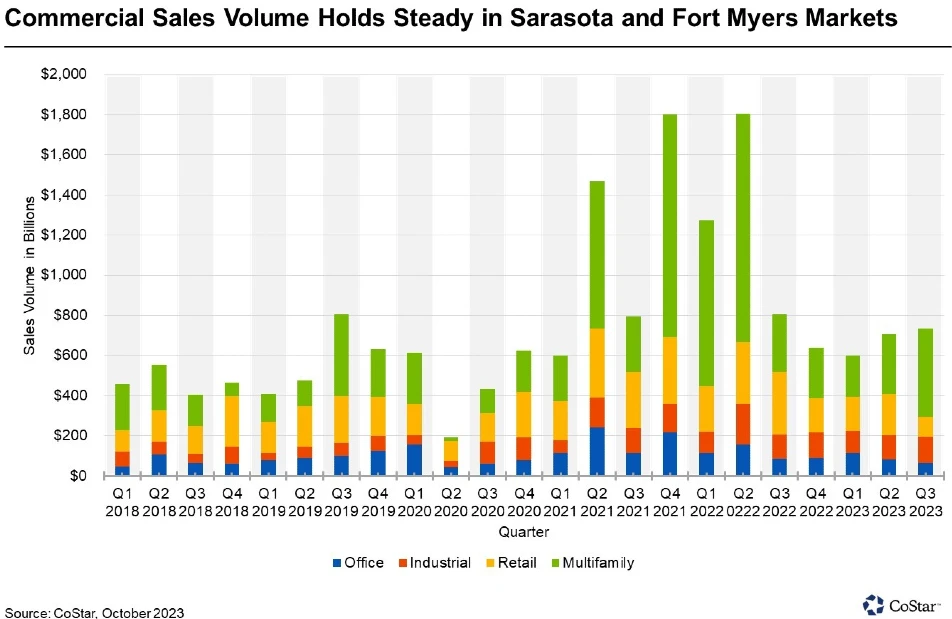

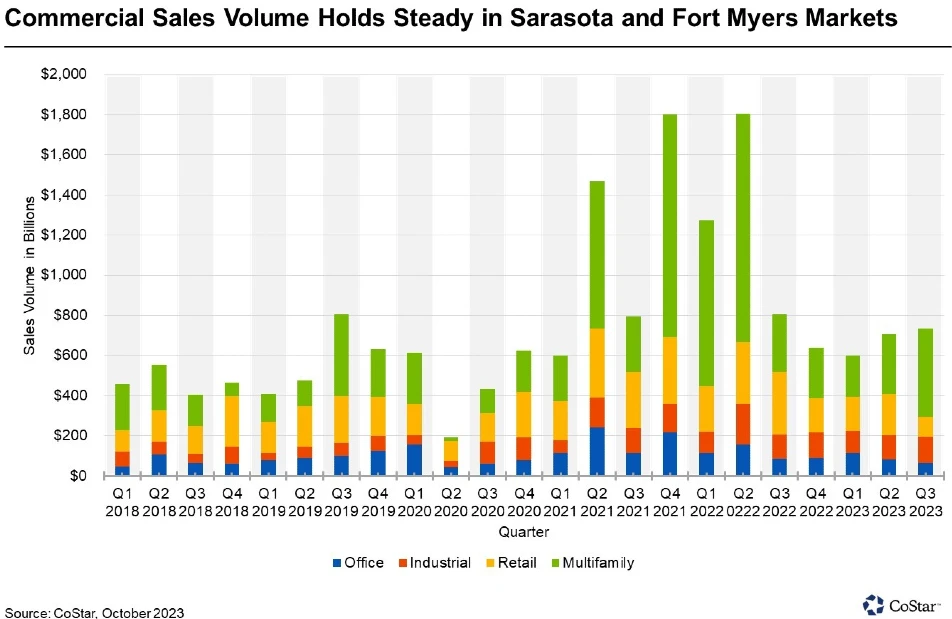

In 2023, the real estate markets in Sarasota and Fort Myers have shown resilience with minimal drops in sales volume. The region achieved approximately $735 million in total sales volume in the third quarter, surpassing pre-pandemic levels. Sarasota accounted for the majority of investment volume at $1.3 billion year-to-date. The multifamily sector performed well but didn’t reach the peak recorded in the second quarter of 2022. Office transactions declined, and industrial investments have remained consistent, with a strong third quarter. The retail sector fluctuated, with the third quarter being the weakest in five years. Private buyers and owner-users continue to dominate the market, contributing to a steady flow of deals, especially in the industrial and multifamily sectors.

Oct 13, 2023

Marriott International and Hilton are capitalizing on the growing demand for hotel-like homes by expanding into the unique segment of hotel-branded residential developments without the hotel component. Traditional sales of condo-style branded residences that are part of luxury hotel developments have driven project funding and appealed to investors in vacation homes and international real estate. Stand-alone branded residences, without the hotel, are becoming popular among luxury travelers who seek the benefits of a luxury hotel brand without the risks of hotel development. Marriott, with 128 branded residential developments globally, has 17% that are stand-alone, and Hilton is about to launch its first stand-alone private residence project. Stand-alone branded residences offer private homeowners luxury amenities like concierge services and security. However, these stand-alone residences are intended for sale, not for hotel rental use, as hotels still cater to their loyal customer bases co-located with hotels.

Oct 11, 2023

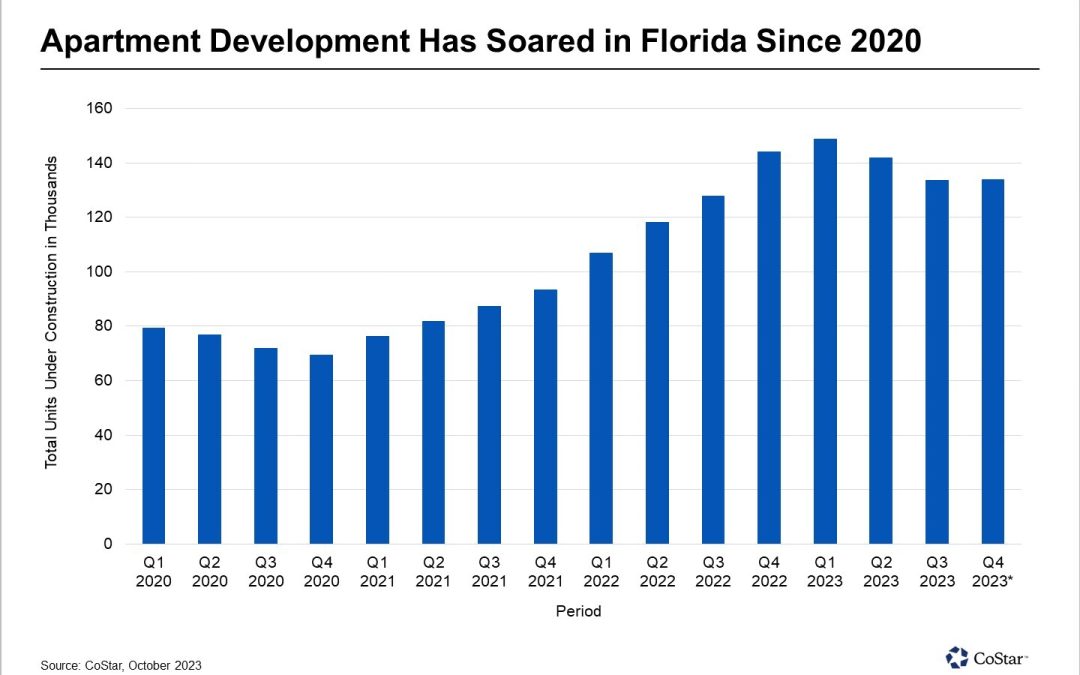

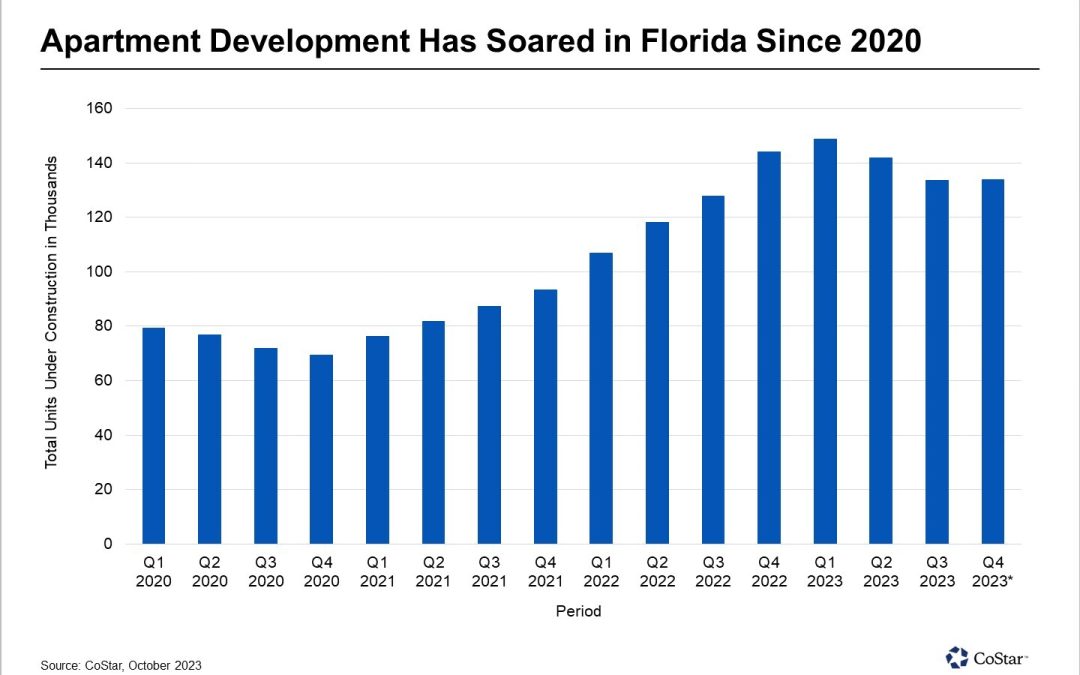

Florida’s multifamily real estate sector has experienced significant growth in development and investment over the past few years due to population growth. However, rising insurance costs, driven by hurricane-related damage and increased reinsurance rates, are now posing challenges for the industry. This surge in insurance expenses, averaging around $2,000 per unit, has led to a potential 10% loss in property value, particularly impacting older properties and wood-frame structures. The situation is seen as an urgent issue that needs to be addressed at the state level to support the multifamily sector’s sustainability.

Oct 3, 2023

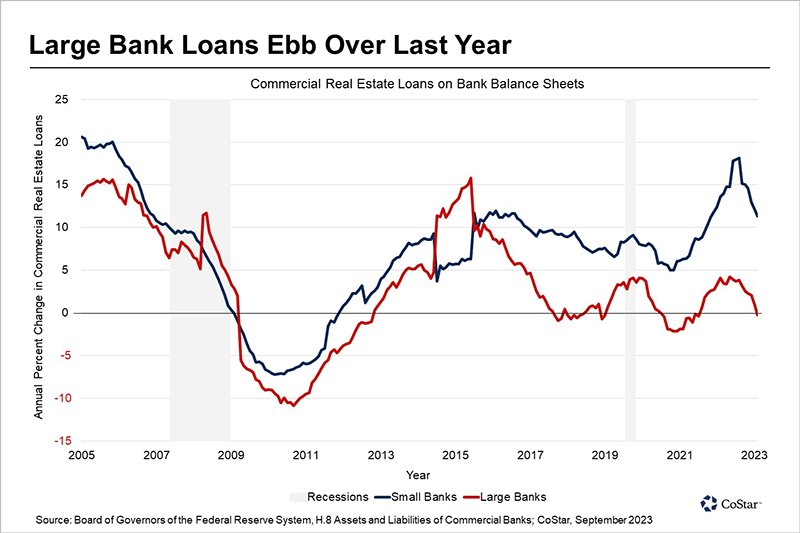

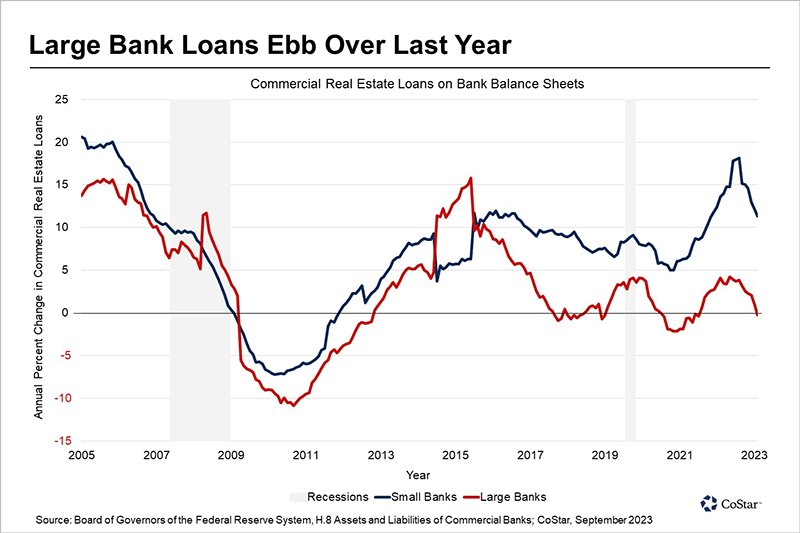

The top 25 banks, holding 31% of all commercial real estate loans, have seen sluggish loan growth since 2016 due to increased regulations, competition from non-bank lenders, and regional banks. In contrast, regional and community banks have averaged 9.7% annual loan growth over eight years. Large banks, with 60% of their loans secured by nonresidential properties, saw a 0.3% decline in commercial real estate loans in September 2023. As $1.9 trillion in commercial real estate loans mature in the next four years, there’s a risk of tighter credit conditions affecting property values and transaction volumes, particularly for office properties.