Nonresidential Lending Slows As About $885 Billion in Bank Loan Maturities Loom

Summary:

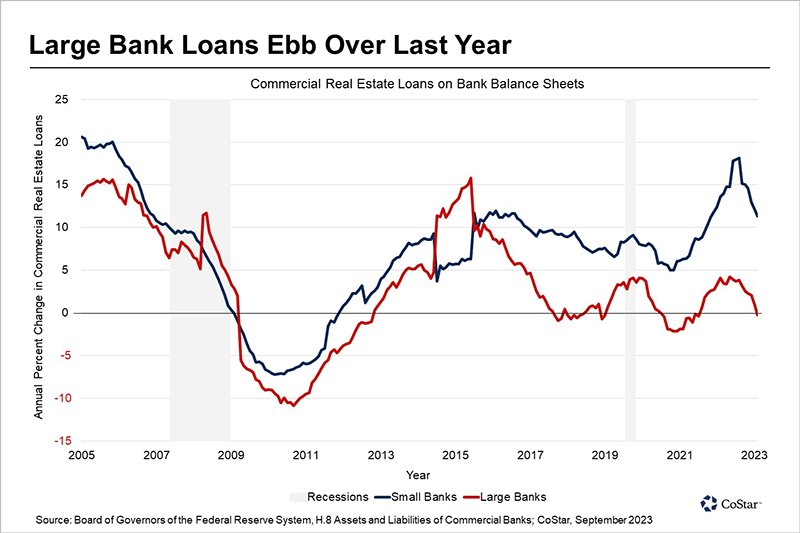

The top 25 banks, holding 31% of all commercial real estate loans, have seen sluggish loan growth since 2016 due to increased regulations, competition from non-bank lenders, and regional banks. In contrast, regional and community banks have averaged 9.7% annual loan growth over eight years. Large banks, with 60% of their loans secured by nonresidential properties, saw a 0.3% decline in commercial real estate loans in September 2023. As $1.9 trillion in commercial real estate loans mature in the next four years, there’s a risk of tighter credit conditions affecting property values and transaction volumes, particularly for office properties.