CoStar News

Summary:

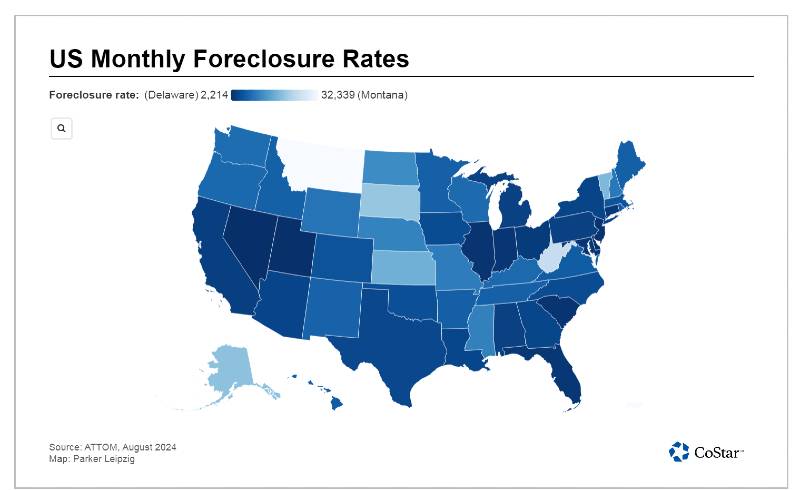

Foreclosure activity in the U.S. is rising, with nearly 32,000 housing units facing default notices or repossessions in July 2024, an 18% increase from June and a slight 0.2% year-over-year rise. Delaware had the highest foreclosure rate, with a 7.37% increase, followed by Nevada, Utah, New Jersey, and Illinois.

Foreclosure starts also increased by 18% from June, with California, Florida, Texas, Illinois, and New York leading in numbers. While completed foreclosures rose by 14% from the previous month, they were down 2% from last year.

Despite the uptick, foreclosure rates remain 68% below pre-recession levels. Rising home prices have boosted homeowner equity, suggesting that while foreclosures are increasing, many homeowners are still financially stable. Monitoring the situation in the coming months will be crucial for understanding the real estate market’s trajectory.