In the News

Plunging Commercial Real Estate Demand Sends Prices Lower

U.S. commercial real estate sales prices have experienced a significant decline as the number of transactions hit near-pandemic lows, according to a CoStar Group analysis for November. The findings indicate that November’s transaction volume was the second-lowest since the depths of the pandemic lockdowns, with a 38.6% drop in sales, amounting to a $3.6 billion reduction from the prior month. The value-weighted U.S. Composite Index, reflecting larger property sales common in major cities, fell by 1.1% in November, marking the third consecutive monthly decline. Investment-grade property fundamentals have worsened in the past 12 months, with a negative contribution and a notable increase in the completion of new space.

US Company Layoffs Jump, House Advances Bill To Boost Transformer Supply, Jobless Claims Rise

In November, U.S. companies announced a total of 45,510 job cuts, marking a 24% increase from the previous month. Despite being 41% lower than the same period the previous year, the year-to-date job cuts in 2023 were more than double the figure for the first 11 months of 2022, totaling 686,860. The technology industry led in announced job cuts for the year, with 163,562, including 5,049 in November. Additionally, the House Energy and Commerce Committee advanced a bill to address the shortage of electrical distribution transformers, while jobless claims increased by 1,000 to 220,000 for the week ending December 2, indicating a tightening job market.

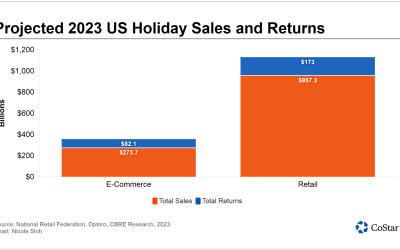

Holiday Returns Becoming Bigger Business for Logistics Companies, Driving Real Estate Decisions

Holiday gift returns have become a significant driver for the third-party logistics industry, with these providers representing nearly 31% of all industrial leases of 100,000 square feet or more in the first three quarters of the year. In the past four years, third-party logistics providers, many of which provide reverse logistics services, have leased more than 100 million square feet of bulk warehouse space annually, according to CBRE.

The growth in e-commerce, expected to account for over 30% of sales by 2030, contributes to the increasing demand for reverse logistics services and the associated real estate. Additionally, some retailers are adopting strategies such as charging return fees and implementing shorter return windows to mitigate excessive returns, with technology and strategic approaches seen as opportunities to turn returns into a revenue-generating aspect of retail.

Pandemic’s Record Apartment Rent Growth Eases

Multifamily rent growth experienced a significant acceleration in 2021 and early 2022, leading to concerns about affordability and calls for rent control. However, since late 2022, the growth has slowed, and in some major markets, rents have even declined. On a national level, the average asking multifamily rent is only $65 higher than it would have been with pre-pandemic growth rates. Markets in Florida, particularly Palm Beach, show the largest positive differences, with rents significantly higher than projected. In contrast, several large coastal California markets, including San Francisco, San Jose, and East Bay, have lower rents than anticipated. The variations are more pronounced between different property types, with four- and five-star properties experiencing the greatest absolute differences. Miami and Orange County have notably higher rents for high-end properties, while San Francisco’s most expensive units are cheaper. Lower-priced one- and two-star properties generally have marginal increases, with some renter households paying slightly less than anticipated in a few markets. Bay Area markets stand out for lower rents in one- and two-star properties compared to pre-pandemic projections, while Palm Beach has higher rents in this category.

El Salvador became the first country to accept Bitcoin as legal tender. Now it’s offering citizenship for a $1 million ‘investment’

After nearly two years of delays, El Salvador’s Bitcoin Volcano Bond has received regulatory approval from the Digital Assets Commission (CNAD) and is expected to be issued in the first quarter of 2024. The bond, named after a plan to use geothermal energy from a volcano for Bitcoin mining, was initially announced by President Nayib Bukele in 2021 after El Salvador adopted Bitcoin as legal tender. The bond’s debut in early 2022 was postponed and faced multiple delays before El Salvador’s congress passed a law in January, creating a legal framework for the bond. The bond could help the nation avoid defaulting on its debt, although the International Monetary Fund has urged El Salvador to eliminate Bitcoin as a legal currency. The funds raised by the Volcano Bond are intended for the creation of a “Bitcoin city” and investments in Bitcoin itself, aligning with El Salvador’s broader embrace of cryptocurrency.

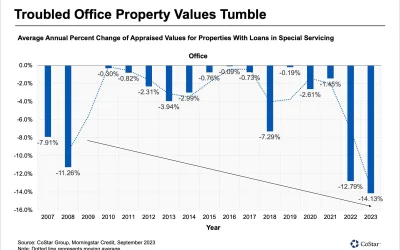

Distressed Office Property Count Set To Shrink, More Loan Troubles in Downtown Philadelphia, Final Offers Being Reviewed for Florida Mall

In November, the number of distressed office properties backed by commercial mortgage-backed securities loans increased by 1.1%, reaching a total of 762 buildings, with a 30% vacancy rate. The distress level may improve as some properties recently received loan modifications. Notable among these is a portfolio of nearly 150 properties in Pennsylvania, securing a $1.27 billion loan, set to be removed from special servicing after a two-year loan extension by Workspace Property Trust. In downtown Philadelphia, the servicer deemed a $126 million loan on the Wanamaker Building nonrecoverable, with an updated appraised value 71.8% below the 2018 value.

Additionally, final offers are being reviewed for the Countryside Mall in Clearwater, Florida, which faced credit rating downgrades, leading to potential losses in a CMBS deal. The 1.4 million-square-foot mall, managed by special servicer Midland Loan Services, was transferred to special servicing in June 2020. JLL is overseeing leasing and management, and while the mall’s value has risen, a pending transaction is under review for approval.

Medical Equipment Provider Leases Space at Fort Myers, Florida, Distribution Center

StateServ, a national provider of durable medical equipment, has secured a five-year lease for a 14,100 square feet space at the Alico Business Park in Fort Myers, Florida. This expansion is part of the company’s operations in 14 states, with a total of 50 distribution centers. The distribution center at 16311 Domestic Ave., built in 2020 and spanning 13.28 acres, is also home to other tenants such as Clevertech and retailer The Coldest Water. The Alico Business Park, comprising four industrial properties totaling 174,600 square feet, hosts a diverse range of tenants including United Way of Lee County and Matter Brothers Furniture. The lease deal was facilitated by Shawn Stoneburner of Cushman & Wakefield representing the owner, and Jeffrey Bucker of Lee & Associates representing StateServ.

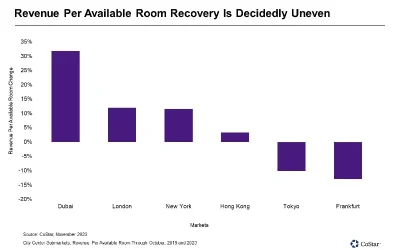

Hotels in Global Financial Markets Struggle to Build Occupancy

Financial centers around the world are grappling with uneven recovery in the hotel industry. These centers rely heavily on corporate travel, and the closure of offices in 2020 disrupted hotel occupancy. Even though people are back in offices, downtown hotel occupancy in major financial hubs like New York and Tokyo is still below pre-2019 levels. Factors like new hotels and the slow return to offices are contributing to this. While some cities like Dubai are bouncing back, challenges in corporate travel demand and economic issues in certain countries may slow down the overall hotel recovery.

More Than 16,000 NYC Hotel Rooms Used To Accommodate Unhoused

In response to the housing needs of the unhoused, refugees, and migrants, over 16,000 hotel rooms in New York City have been repurposed, with 140 hotels no longer available for travelers as of October. Various city and county authorities have secured these accommodations through long-term leases, reducing future hotel room supply. The impact is particularly noticeable in different market segments, with a concentration of projects in major areas like midtown, Queens/Brooklyn, and JFK/Jamaica. The transformation of these hotels, most of which were midscale or economy properties, may have a lasting effect on New York City’s hotel performance, potentially leading to higher average daily rates in the future. Despite ongoing construction, the city’s supply pipeline for new hotels is expected to be limited due to recent zoning and development regulations.

Amazon Ratchets Up Warehouse Sublease Offerings Offsetting Newly Leased Space

Amazon has vacated over 14 million square feet of distribution space in the U.S. in the past 16 months, constituting about 3% of its U.S. logistics footprint. Most closures occurred in the latter half of 2022 as Amazon focused on shutting down older, less efficient facilities. The company has recently increased its sublease offerings, with the unique aspect being that more of these involve opportunities through 2030 and beyond in larger, newly built distribution properties. Despite these closures, Amazon’s total U.S. logistics square footage appears to remain stable in 2023, with new leases offsetting the volume of closures.

Consumer Confidence Slips for Fourth Month, Retailers Expand Seasonal Hiring, Jobless Claims Edge Lower

Consumer sentiment in the U.S. declined for the fourth consecutive month, with the University of Michigan’s sentiment index dropping to 60.4 in November, down from 63.8 in October. Concerns about high interest rates, inflation, and global political unrest contributed to the decline, particularly affecting lower-income and younger consumers. Despite retailers adding 3% more jobs in October compared to the previous year in anticipation of the holiday season, transportation and warehousing jobs fell by 27%. Additionally, while initial claims for unemployment insurance remained low at 217,000 for the week ending Nov. 4, continuing claims increased for the seventh consecutive week, suggesting challenges in finding new employment for some individuals.

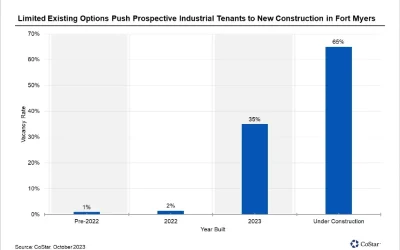

Swollen Construction Pipeline Could Cause Jump in Fort Myers Industrial Vacancy

Fort Myers, in Southwest Florida, has seen significant activity in new industrial development with 3.9 million square feet currently under construction, following the completion of 1.4 million square feet. However, recent completions have surpassed tenant move-ins, leading to a slight increase in vacancy rates to 2.4%, marking the first time the vacancy rate has averaged over 2% in a year. It’s projected that the vacancy rate will continue to rise, potentially peaking at around 6% by the end of 2024. Despite this increase, Fort Myers remains a desirable industrial market with strong tenant interest, particularly for spaces under 50,000 square feet. Vacancy is expected to normalize to 2% to 3% in the long term.

Biden Administration Publishes Guidelines To Encourage Commercial-to-Residential Conversions

54-Page Guide Outlines Federal Resources Available to Developers and Landlords By Parimal M. Rohit, CoStar News Amid a housing shortage in U.S. cities, various initiatives are looking to convert underused office spaces in central business districts into residential...

Hotels Step Up Offerings To Entice Guests Who Travel With Their Pets

Hotels are increasingly offering a range of amenities and services to pamper pet owners and their pet companions. These services go beyond the traditional water bowls and plush beds, with offerings such as nutritious, fresh dog food in hotel restaurants, “Yappy” hours, play areas, dog mini poolside cabanas, and even doggie turn-down service. Some hotels have specific pet packages, including access to telehealth appointments for pets and dedicated pet concierges, catering to both traditional and non-typical emotional support animals and exotic pets. These pet-friendly amenities aim to enhance the guest experience for pet owners and their beloved animals while contributing to a more comfortable environment for all guests.

Luxury Community Breaks Ground As Land Scarcity Challenges Development in Florida

13th Floor Homes has initiated the construction of Marina Landings, a luxury gated community in Fort Lauderdale, Florida, featuring 34 single-family homes. The project addresses the challenge of scarce available land in South Florida by repurposing infill sites. The development, located near the airport and downtown, offers homes starting in the low 1-millions, with various floor plans, and is expected to be completed in 2024. The demand for single-family homes in the region has led the company to expand its presence into various Florida submarkets.

Largest US Single-Family Rental Owner Says It Too Is Having Trouble Finding Houses To Buy

Invitation Homes, the largest owner of single-family rentals in the US with around 85,000 properties, is facing challenges in finding properties to purchase. Despite a strong demand for rental homes, the company struggles to acquire suitable properties, often getting outbid when they do find something that fits their criteria. They are turning to homebuilders to strengthen their portfolio and have formed partnerships with them to build new homes. Invitation Homes reported revenues of $618 million in the third quarter, with a robust leasing market and rents returning to historical norms. They are also selling older, non-core properties to fund new acquisitions, with a construction pipeline of 1,931 homes in partnership with third-party builders. The company is well-positioned with ample liquidity for potential merger and acquisition deals in the future.

Rite Aid Files for Bankruptcy Protection, Plans Store Closings

Rite Aid, a pharmacy chain, has filed for Chapter 11 bankruptcy protection due to significant debt and opioid-related litigation. The company received a commitment of $3.45 billion from creditors and lenders to support its operations and financial restructuring. The bankruptcy is expected to result in the closure of hundreds of Rite Aid stores. The filing will address the opioid-related lawsuits and help the company optimize its store footprint, with plans to close underperforming stores. Jeffrey Stein has been appointed as the new CEO and chief restructuring officer. Rite Aid has been struggling financially, with ongoing losses and a substantial debt burden.

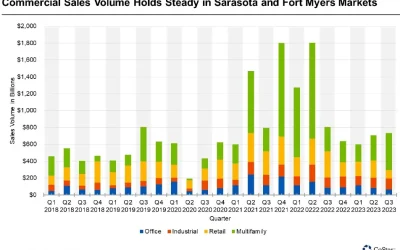

Investment Sales Volume Remains Consistent in Sarasota and Fort Myers

In 2023, the real estate markets in Sarasota and Fort Myers have shown resilience with minimal drops in sales volume. The region achieved approximately $735 million in total sales volume in the third quarter, surpassing pre-pandemic levels. Sarasota accounted for the majority of investment volume at $1.3 billion year-to-date. The multifamily sector performed well but didn’t reach the peak recorded in the second quarter of 2022. Office transactions declined, and industrial investments have remained consistent, with a strong third quarter. The retail sector fluctuated, with the third quarter being the weakest in five years. Private buyers and owner-users continue to dominate the market, contributing to a steady flow of deals, especially in the industrial and multifamily sectors.

No Hotel, No Problem: Marriott, Hilton Attract Development Dollars for Stand-Alone Branded Residences

Marriott International and Hilton are capitalizing on the growing demand for hotel-like homes by expanding into the unique segment of hotel-branded residential developments without the hotel component. Traditional sales of condo-style branded residences that are part of luxury hotel developments have driven project funding and appealed to investors in vacation homes and international real estate. Stand-alone branded residences, without the hotel, are becoming popular among luxury travelers who seek the benefits of a luxury hotel brand without the risks of hotel development. Marriott, with 128 branded residential developments globally, has 17% that are stand-alone, and Hilton is about to launch its first stand-alone private residence project. Stand-alone branded residences offer private homeowners luxury amenities like concierge services and security. However, these stand-alone residences are intended for sale, not for hotel rental use, as hotels still cater to their loyal customer bases co-located with hotels.

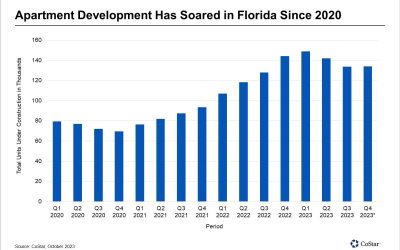

Rising Insurance Costs Deter Multifamily Investment and Development in Florida

Florida’s multifamily real estate sector has experienced significant growth in development and investment over the past few years due to population growth. However, rising insurance costs, driven by hurricane-related damage and increased reinsurance rates, are now posing challenges for the industry. This surge in insurance expenses, averaging around $2,000 per unit, has led to a potential 10% loss in property value, particularly impacting older properties and wood-frame structures. The situation is seen as an urgent issue that needs to be addressed at the state level to support the multifamily sector’s sustainability.

Florida overtakes NY as nation’s second most valuable housing market

Florida has overtaken New York as the second most valuable housing market in the United States, with its residential property values surging by $160 billion over the year starting in June 2022, according to research by Zillow. This shift is attributed to increased demand for living in Florida, driven by factors such as the pandemic-induced exodus from high-tax and high-restriction states. California remains the most expensive residential real estate market, although its property values decreased by 3.3% since June of the previous year. Overall, Florida’s housing stock is now worth $3.8 trillion, surpassing New York’s $3.69 trillion, with Miami emerging as one of the top five metropolitan areas in terms of housing stock value. New York City still holds the top spot, with its real estate valued at $4.24 trillion, followed by Los Angeles with $3.71 trillion.

VanEck’s New Contrarian Office Fund Hits Immediate Bump

VanEck’s new exchange-traded fund (ETF) tied to office real estate investment trusts (REITs) faced an immediate setback when one of its holdings, W.P. Carey, announced its exit from the office sector, causing a 7% drop in the ETF’s share values just one day after its launch. Despite this setback, some industry experts, such as Sher Hafeez from JLL Securities, remain optimistic about a potential long-term rebound in office REIT valuations. VanEck maintains its confidence in the office sector’s recovery prospects, emphasizing the benefits of its ETF structure for diversified exposure to the category. The office sector faces challenges, but it also presents opportunities, with signs of improved performance in certain segments and shifting investor attitudes.

The Consumer’s Next Big Test: Student Loan Repayments

The impending restart of student loan payments on October 1, impacting 43 million borrowers with $1.6 trillion in outstanding debt, raises concerns about its effect on consumer spending, a key economic driver. While the Department of Education’s income-driven SAVE plan offers relief for many borrowers, the Federal Reserve’s interest rate hikes and falling median household incomes are already straining consumers. Rising delinquency rates on credit card and auto debt further compound the challenge. Although shifting budgets toward student loan payments may cause a modest drop in personal consumption expenditures, consumer spending remains pivotal for the economy’s stability. Additionally, the housing market faces ongoing difficulties, marked by high mortgage rates and low inventory, as the National Association of Home Builders Housing Market Index declines for the second consecutive month.

Amazon Looks for New Property With High Ceilings As It Plans Major Expansion

Amazon has plans to double the number of same-day delivery centers it operates, which are seen as the fastest and cost-effective fulfillment mechanism for the company. These facilities are designed to streamline the process of getting items from order to delivery readiness in as little as 11 minutes. Amazon’s same-day delivery centers are strategically located based on population density, with some of the most populous metropolitan areas having multiple centers. The facilities are typically located in buildings with high ceilings, averaging 33 feet, allowing for tall racking systems to accommodate a large volume of merchandise. The company focuses on properties ranging from 100,000 to 225,000 square feet in size. The expansion of these facilities is expected to enhance Amazon’s delivery speed for customers.

Decline in Office Values Outpaces Great Recession

Decline in Office Values Outpaces Great Recession, Blackstone-Owned New York Office Building Goes Up for Sale, Silver Star To Sell Properties Tied to Loan By Mark Heschmeyer and Nicole Shih, CoStar News, September 21, 2023 | 10:19 A.M. Decline in Office Values...