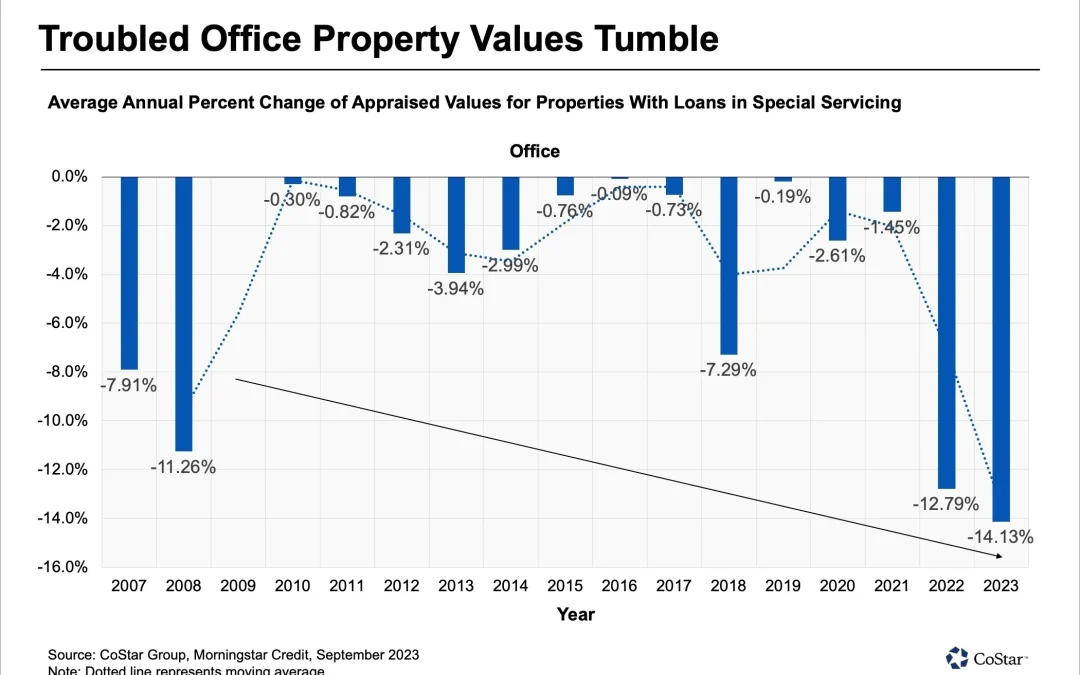

Decline in Office Values Outpaces Great Recession: The values of office properties financed by troubled loans in commercial mortgage-backed securities have been reappraised lower in 2022 and 2023 to a greater degree than in 2008 during the Great Recession, according to a CoStar News analysis of Morningstar Credit data.

CMBS special servicers are required to obtain new appraisals every year on loans that have troubling issues such as making regular payments, delinquencies at maturity and defaults. For 2022 and 2023, the office properties backing such loans have been reappraised lower by an average of 12.8% in 2022 and 14.1% so far this year. That beats average write-downs of 11.3% in 2008.

New appraisals have wiped out more than $17 billion in value on office properties backed by specially serviced CMBS loans since year-end 2021. By comparison, securitized multiborrower and single-borrower multifamily properties have lost $5.5 billion in value in the same period; hospitality properties have lost $3.4 billion in value; and anchored retail properties have lost just $9 million in value.

Of note, the value of multifamily properties with securitized Freddie Mac loans has gained $1.8 billion in the same time frame. Freddie Mac acquires loans on multifamily properties using tighter lending guidelines, which contributes to higher values.

Office operating performance has been clobbered by shrinking demand as tenants cut back on space requirements, while the persistence of high interest rates keeps the cost of capital elevated.