Feb 1, 2024

The U.S. economy defied predictions of a recession in 2023, closing the year with a robust 3.3% annualized growth in the fourth quarter, as reported by the Bureau of Economic Analysis. The diverse growth was spread across consumer spending, business investments, trade, and government spending. A “Goldilocks scenario” was observed, with all major GDP components growing within a 1.5% to 4% range. Concerns about the sustainability of consumer spending arise due to increased reliance on credit cards, rising delinquencies, and a low personal savings rate, suggesting a potential economic slowdown.

Jan 11, 2024

Fitch Ratings anticipates a significant deterioration in the prospects for U.S. commercial real estate loan refinancing in 2024, leading to an increase in commercial mortgage-backed securities (CMBS) delinquency rates across major property sectors. The overall U.S. CMBS delinquency rate is projected to rise from 2.25% in November 2023 to 4.5% in 2024 and 4.9% in 2025, driven by factors such as maturity defaults, higher interest rates, tighter access to capital, and fewer special servicing resolutions. The office delinquency rate is expected to more than double by 2025 due to hybrid work policies, while retail, hotel, and multifamily loan delinquency rates are also forecasted to increase. Additionally, higher interest rates in 2023 led to a trend of shorter-term, five-year fixed-rate loans in the commercial real estate securitization market. Furthermore, Wells Fargo’s recent non-recoverability determinations for CMBS deal JPMCC 2013-C16 highlight a potential shift in servicer decisions based on deal-level parameters, impacting interest payments for bondholders but potentially offering a future upside through property liquidations.

Jan 9, 2024

Miami Worldcenter, a $6 billion, 27-acre mixed-use development, has faced challenges over the years, including delays due to the Great Recession and the impact of the COVID-19 pandemic. The project, the second-largest of its kind in the United States, aims to reshape Miami’s urban core by focusing on pedestrian-friendly spaces and creating a walkable neighborhood. Despite setbacks, the development is nearing completion, with over 90% of its 300,000 square feet of retail space leased. The project includes residential units, offices, public green areas, and a variety of amenities, contributing to Miami’s status as a growing global city.

Jan 7, 2024

U.S. commercial real estate sales prices have experienced a significant decline as the number of transactions hit near-pandemic lows, according to a CoStar Group analysis for November. The findings indicate that November’s transaction volume was the second-lowest since the depths of the pandemic lockdowns, with a 38.6% drop in sales, amounting to a $3.6 billion reduction from the prior month. The value-weighted U.S. Composite Index, reflecting larger property sales common in major cities, fell by 1.1% in November, marking the third consecutive monthly decline. Investment-grade property fundamentals have worsened in the past 12 months, with a negative contribution and a notable increase in the completion of new space.

Jan 6, 2024

In November, U.S. companies announced a total of 45,510 job cuts, marking a 24% increase from the previous month. Despite being 41% lower than the same period the previous year, the year-to-date job cuts in 2023 were more than double the figure for the first 11 months of 2022, totaling 686,860. The technology industry led in announced job cuts for the year, with 163,562, including 5,049 in November. Additionally, the House Energy and Commerce Committee advanced a bill to address the shortage of electrical distribution transformers, while jobless claims increased by 1,000 to 220,000 for the week ending December 2, indicating a tightening job market.

Dec 26, 2023

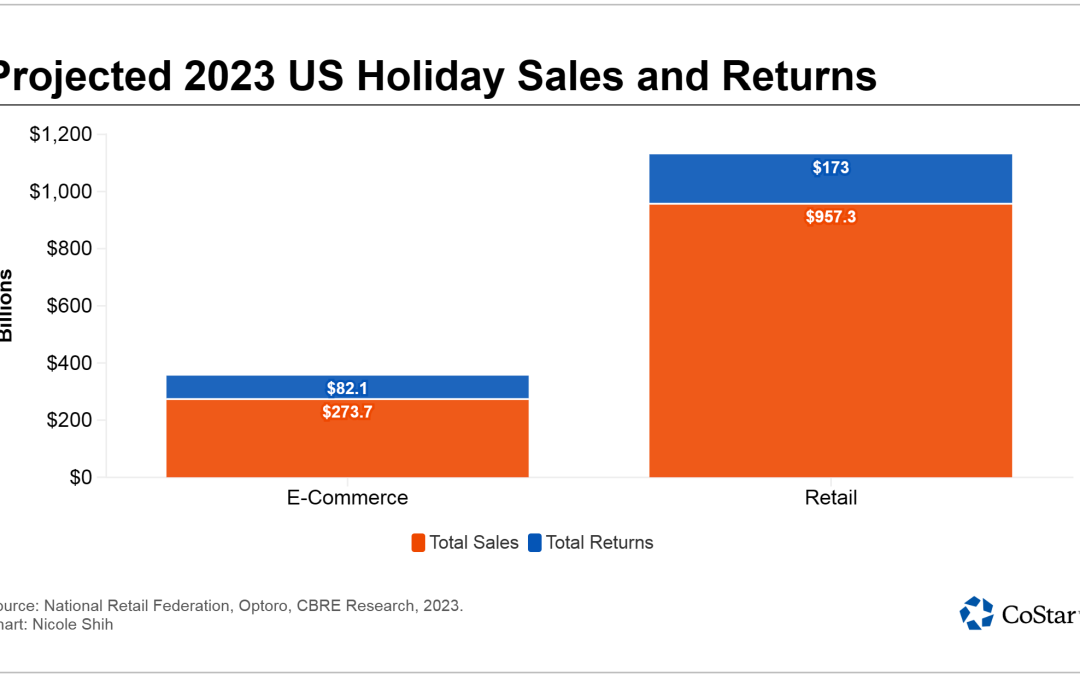

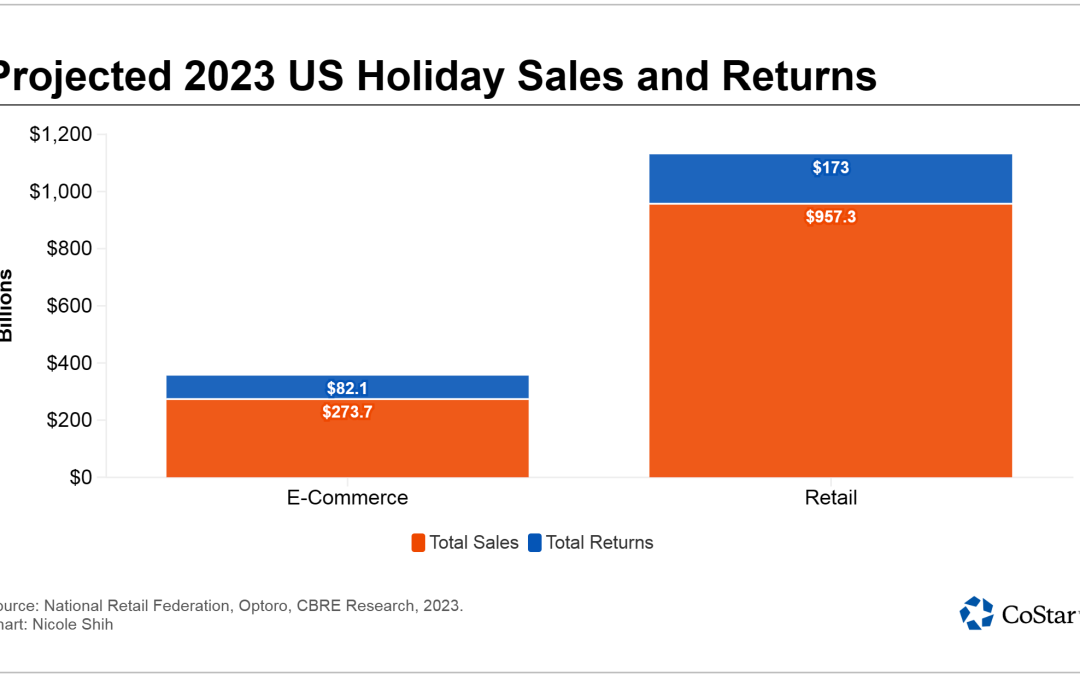

Holiday gift returns have become a significant driver for the third-party logistics industry, with these providers representing nearly 31% of all industrial leases of 100,000 square feet or more in the first three quarters of the year. In the past four years, third-party logistics providers, many of which provide reverse logistics services, have leased more than 100 million square feet of bulk warehouse space annually, according to CBRE.

The growth in e-commerce, expected to account for over 30% of sales by 2030, contributes to the increasing demand for reverse logistics services and the associated real estate. Additionally, some retailers are adopting strategies such as charging return fees and implementing shorter return windows to mitigate excessive returns, with technology and strategic approaches seen as opportunities to turn returns into a revenue-generating aspect of retail.