May 17, 2024

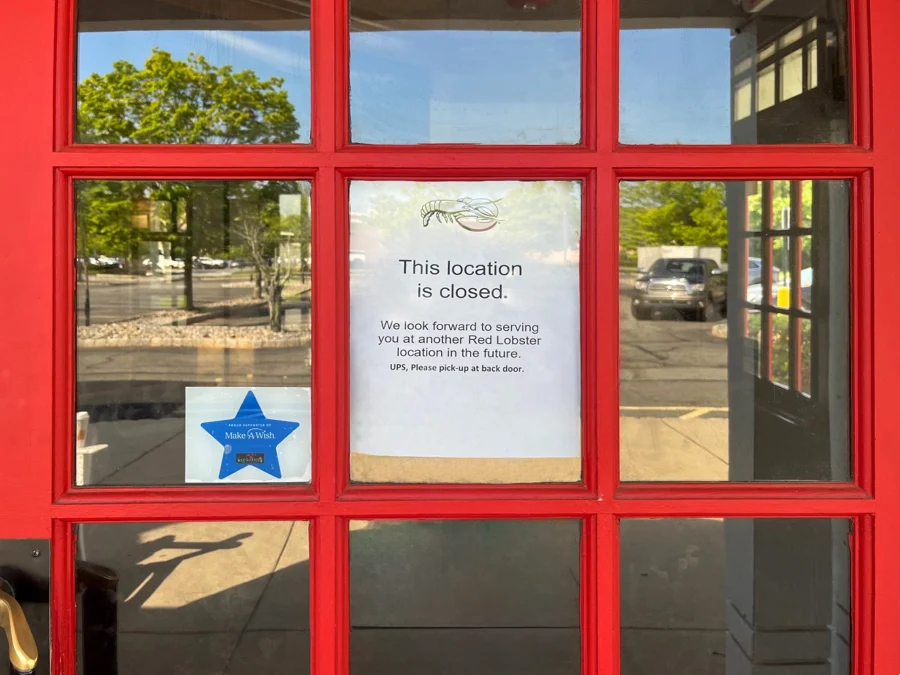

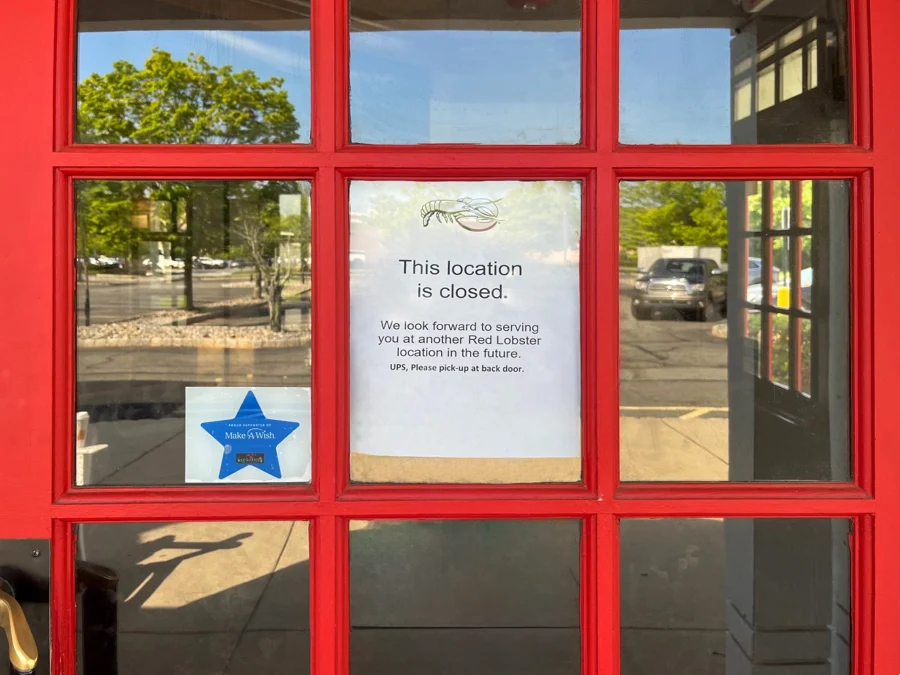

Red Lobster has abruptly closed about 100 of its roughly 700 restaurants and is auctioning off equipment from many of these sites. The closures come amid reports that the chain is considering filing for Chapter 11 bankruptcy protection. TAGeX Brands, a restaurant industry liquidator, announced it is conducting a large-scale auction of equipment from over 50 Red Lobster locations, with the first auctions ending soon. The closures and financial struggles have surprised employees and patrons alike. Factors contributing to Red Lobster’s difficulties include the pandemic, high interest rates, labor costs, and an unsuccessful all-you-can-eat shrimp promotion. The chain has been seeking a buyer to avoid bankruptcy, but its largest investor, Thai Union, has also expressed intentions to sell its stake due to sustained financial losses.

Read Full Article on CoStar HERE

May 1, 2024

The S&P Corelogic Case-Shiller Index revealed a robust 6.4% annual increase in single-family house prices in the United States in February, surpassing January’s record-high growth. All cities in the index reported annual price growth, with San Diego experiencing the largest increase for the second consecutive month. Despite economic uncertainty, fueled by inflation concerns and rising mortgage rates, housing prices continue to soar, reaching all-time highs in cities like San Diego, Los Angeles, New York, and Washington, D.C. However, this persistent growth, coupled with limited supply and higher mortgage rates, is exacerbating housing affordability issues, prompting more prospective buyers to opt for renting over buying.

Read the full article on CoStar HERE

Apr 11, 2024

The article reports that BH Kolter is set to acquire a Naples condo complex for $100 million. The property, known as the Mangrove Bay Condominiums, consists of 53 units and spans over 9 acres. The acquisition represents BH Kolter’s continued expansion in the Florida real estate market. The deal underscores the robust demand for luxury residential properties in desirable locations like Naples.

Read the full article onCoStar HERE

Apr 8, 2024

Blackstone has agreed to acquire Apartment Income REIT (AIR Communities) for approximately $10 billion, marking its largest multifamily transaction to date. The deal, valued at $39.12 per share, reflects Blackstone’s renewed interest in the property market following a pause in investments in 2023 due to increased interest rates. The acquisition aligns with Blackstone’s strategy to capitalize on prime multifamily markets and signals a potential uptick in commercial real estate activity in 2024 amidst stabilized interest rates.

Read Full Article on CoStar HERE

Mar 25, 2024

Bank of America, the largest tenant at Fifth Third Center in Charlotte, plans to vacate all 13 floors it leases before its lease expires in July 2025, indicating a trend of financial companies scaling back on real estate in Charlotte. The bank cited a preference for owning office space rather than leasing as a reason for the move. Cousins Properties, the landlord, intends to renovate the space to attract new tenants amidst a broader trend of consolidating office space among Charlotte’s major employers. This move by Bank of America aligns with its broader strategy of refining its real estate portfolio, including closing underperforming branches and expanding into new markets.

Mar 5, 2024

A bidding war for Macy’s, concurrent with the retailer’s plan to close 150 stores, has significant implications for shopping mall owners and the loans financing these centers. While a buyout could be beneficial with a financially strong new owner, closures may spell trouble for malls and lenders. Macy’s anchors numerous malls, totaling over 100 million square feet, with about $24 billion in loans linked to these properties. The potential closure of Macy’s stores could lead to reduced foot traffic, lower sales for neighboring tenants, and decreased revenue for landlords. Weaker-performing malls are likely targets for closures, exacerbating their decline. Co-tenancy clauses triggered by anchor store closures could affect inline tenants, potentially leading to reduced rents or concessions. Overall, these developments indicate possible repercussions for mall viability and associated loans.