Dec 9, 2024

The U.S. Department of Housing and Urban Development (HUD) and the Federal Emergency Management Agency (FEMA) have launched the Pre-Disaster Housing Initiative to help states better prepare for housing challenges following natural disasters. This program, prompted by devastating events like Hurricanes Helene and Milton, aims to boost post-disaster housing capabilities and protect people and infrastructure. Initially, the initiative will provide eight months of technical assistance to officials in Kentucky, Michigan, and Missouri. Additionally, HUD extended foreclosure moratoriums for FHA-backed mortgages in disaster-affected areas through April 11.

Dec 5, 2024

Ken Griffin, CEO of Citadel, owns a 4.2-acre site in Miami’s Brickell neighborhood where he plans to build Citadel’s new headquarters. However, a 22-story condominium building called Solaris at Brickell Bay stands in the middle of this site.

Over the past two years, nearly half of the 141 units in Solaris have been purchased by similarly named Delaware LLCs, sparking speculation that Griffin may be behind these acquisitions. These purchases have been made in all-cash transactions, with recent units selling for around $750,00.

The buyout strategy is significant because if a buyer acquires 80% of the units, they can potentially force the remaining owners to sell, paving the way for redevelopment. This approach is increasingly common in Miami due to the scarcity of available waterfront parcels.

Residents of Solaris have grown suspicious, with one noting that Citadel’s head of real estate viewed their LinkedIn profile[8]. The condo association recently passed a $2 million assessment for repairs, which some residents believe might be a tactic to pressure owners to sell.

Griffin’s spokesman has declined to comment on the matter, leaving the identity of the mystery buyer unconfirmed. If Griffin is indeed behind these purchases, it could allow for further expansion of his planned development, which includes a 54-story tower with offices, a hotel, and restaurants.

Dec 4, 2024

Elon Musk, co-leader of the newly formed Department of Government Efficiency, plans to enforce a full five-day workweek for all federal employees as part of efforts to slash government spending and regulations. Musk and fellow Trump administration adviser Vivek Ramaswamy argue that work-from-home policies are an expired “privilege” and that requiring in-office presence could lead to voluntary terminations, potentially reducing the federal bureaucracy by 25%. This initiative aligns with Musk’s commitment to cut at least $2 trillion from the annual U.S. budget and reduce the number of government agencies. However, the proposal faces opposition from government employee unions and may conflict with the federal government’s ongoing efforts to reduce its leased office space, particularly in Washington D.C., where office vacancy rates have reached record highs.

Oct 26, 2024

McGarvey Development Company, a comprehensive construction and real estate firm, sold Centerlinks Business, which includes nine industrial warehouses. Totaling 453,940 square feet on 41 acres, the park is located at 16770 Oriole Road in Fort Myers. The business park sold for $92.5 million. The property was purchased by EQT Exeter, a company with over 30 years in the industry and a portfolio exceeding $30 billion in managed real estate assets. The private equity company has now broken Lee County’s industrial sales record.

Oct 12, 2024

1. Multifamily loans are experiencing a surge as office deals decline, highlighted by the Bank of Montreal’s upcoming multiborrower commercial mortgage-backed securities deal, which features over half of its $960 million in multifamily loans. This marks a significant increase from previous years, as multifamily loans typically comprised only 21% of such offerings this year.

2. Meanwhile, the Hyatt Regency St. Louis is facing financial difficulties, with a $93.4 million loan entering special servicing due to declining net cash flow and occupancy rates.

3. Additionally, One Worldwide Plaza in New York has also moved to special servicing following the exit of a major tenant, Cravath, which has lowered occupancy from 90% to 65%. Overall, the office sector is struggling, with a significant drop in office loans and rising vacancy rates exacerbated by corporate relocations.

Oct 2, 2024

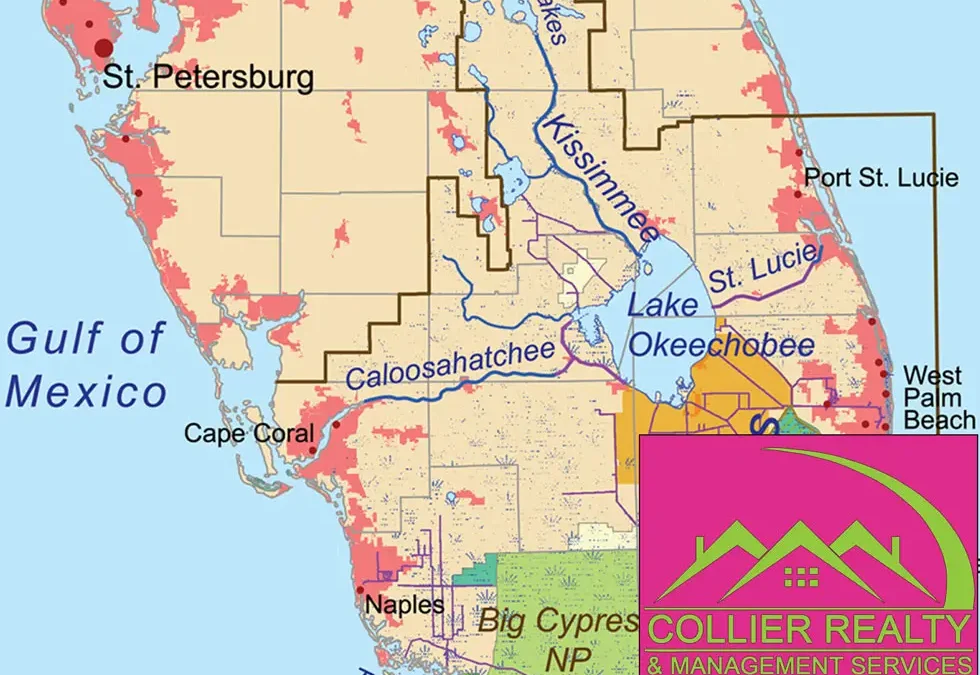

As climate change continues to impact coastal regions, Florida is taking steps to protect homeowners and buyers. The Sunshine State’s latest legislative effort, CS/SB 484: Flood Disclosure in the Sale of Real Property, aims to bring more transparency to the real estate market when it comes to flood risks. This new bill could significantly change how properties are bought and sold in Florida, a state known for its beautiful beaches and occasional hurricanes.

For Buyers

This bill is good news for people looking to buy a home in Florida. Here’s what it means for you:

- You’ll get more information about flood risks before you buy a house.

- The seller must tell you if the house has ever had flood damage.

- You’ll know if the house is in a flood zone.

- The seller has to share if they have flood insurance.

This information can help you make a smarter choice when buying a home.

For Sellers

If you’re selling a house in Florida, this bill means you’ll need to do a few new things:

- You must tell buyers about any past flood damage to the house.

- You have to share if the house is in a flood zone.

- You need to let buyers know if you have flood insurance.

- You must give this information to buyers before they sign a contract.

These new rules mean you’ll need to be more open about flood risks when selling your home.