Nov 17, 2023

Amazon has vacated over 14 million square feet of distribution space in the U.S. in the past 16 months, constituting about 3% of its U.S. logistics footprint. Most closures occurred in the latter half of 2022 as Amazon focused on shutting down older, less efficient facilities. The company has recently increased its sublease offerings, with the unique aspect being that more of these involve opportunities through 2030 and beyond in larger, newly built distribution properties. Despite these closures, Amazon’s total U.S. logistics square footage appears to remain stable in 2023, with new leases offsetting the volume of closures.

Nov 16, 2023

Consumer sentiment in the U.S. declined for the fourth consecutive month, with the University of Michigan’s sentiment index dropping to 60.4 in November, down from 63.8 in October. Concerns about high interest rates, inflation, and global political unrest contributed to the decline, particularly affecting lower-income and younger consumers. Despite retailers adding 3% more jobs in October compared to the previous year in anticipation of the holiday season, transportation and warehousing jobs fell by 27%. Additionally, while initial claims for unemployment insurance remained low at 217,000 for the week ending Nov. 4, continuing claims increased for the seventh consecutive week, suggesting challenges in finding new employment for some individuals.

Nov 7, 2023

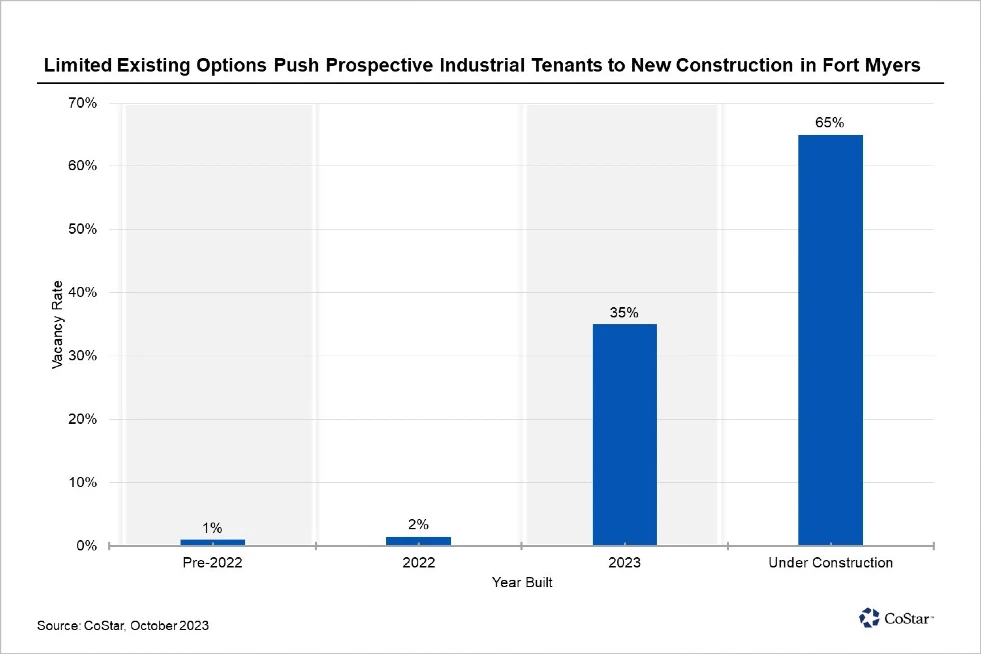

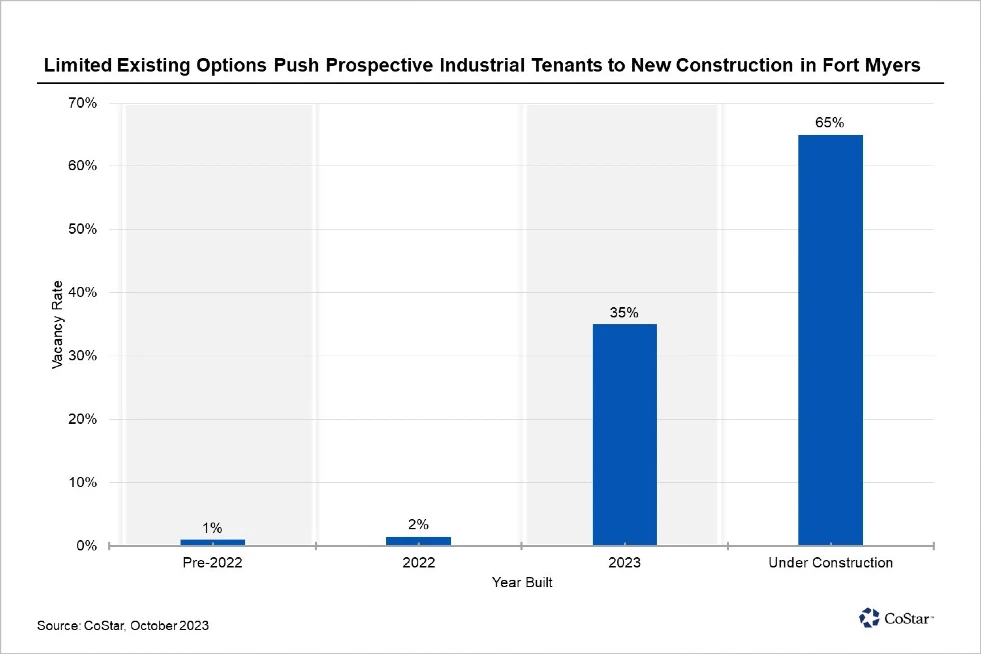

Fort Myers, in Southwest Florida, has seen significant activity in new industrial development with 3.9 million square feet currently under construction, following the completion of 1.4 million square feet. However, recent completions have surpassed tenant move-ins, leading to a slight increase in vacancy rates to 2.4%, marking the first time the vacancy rate has averaged over 2% in a year. It’s projected that the vacancy rate will continue to rise, potentially peaking at around 6% by the end of 2024. Despite this increase, Fort Myers remains a desirable industrial market with strong tenant interest, particularly for spaces under 50,000 square feet. Vacancy is expected to normalize to 2% to 3% in the long term.

Nov 1, 2023

Hotels are increasingly offering a range of amenities and services to pamper pet owners and their pet companions. These services go beyond the traditional water bowls and plush beds, with offerings such as nutritious, fresh dog food in hotel restaurants, “Yappy” hours, play areas, dog mini poolside cabanas, and even doggie turn-down service. Some hotels have specific pet packages, including access to telehealth appointments for pets and dedicated pet concierges, catering to both traditional and non-typical emotional support animals and exotic pets. These pet-friendly amenities aim to enhance the guest experience for pet owners and their beloved animals while contributing to a more comfortable environment for all guests.

Oct 31, 2023

13th Floor Homes has initiated the construction of Marina Landings, a luxury gated community in Fort Lauderdale, Florida, featuring 34 single-family homes. The project addresses the challenge of scarce available land in South Florida by repurposing infill sites. The development, located near the airport and downtown, offers homes starting in the low 1-millions, with various floor plans, and is expected to be completed in 2024. The demand for single-family homes in the region has led the company to expand its presence into various Florida submarkets.