Oct 17, 2024

Hurricane Milton made landfall on October 9 near Sarasota, causing heavy rainfall and flooding across Tampa Bay, particularly in Pinellas and Hillsborough Counties. This followed the devastation from Hurricane Helene, which brought significant storm surges less than two weeks earlier. The multifamily housing sector appears to be the most affected, with numerous properties experiencing flood damage, particularly on first floors. Construction delays are expected, and short-term spikes in leasing may occur as displaced residents seek temporary housing. However, these gains could be temporary, similar to trends observed after Hurricane Ian in 2022.

Oct 2, 2024

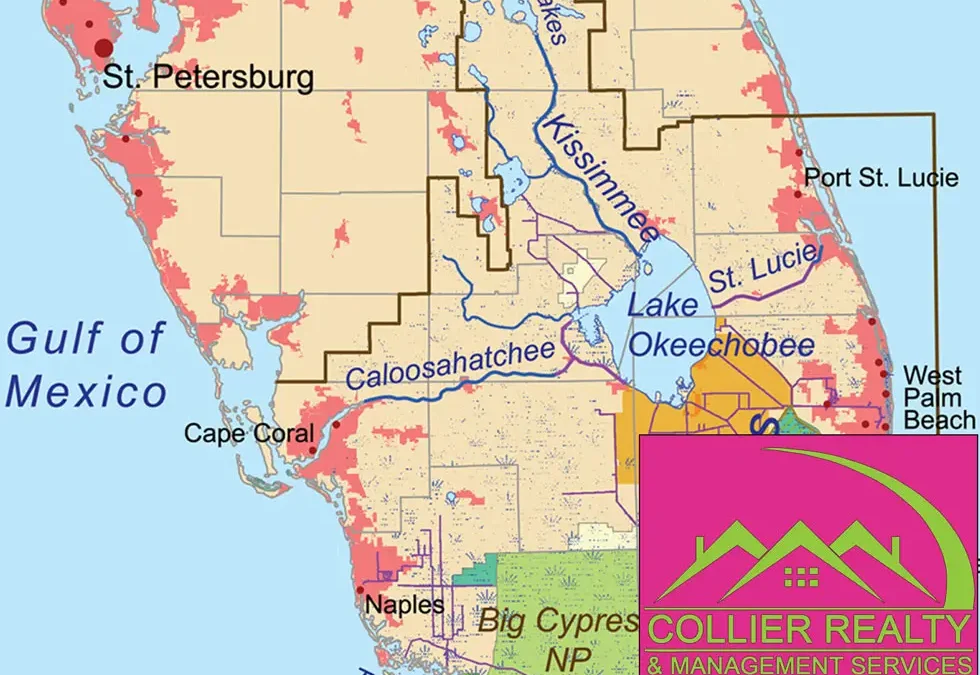

As climate change continues to impact coastal regions, Florida is taking steps to protect homeowners and buyers. The Sunshine State’s latest legislative effort, CS/SB 484: Flood Disclosure in the Sale of Real Property, aims to bring more transparency to the real estate market when it comes to flood risks. This new bill could significantly change how properties are bought and sold in Florida, a state known for its beautiful beaches and occasional hurricanes.

For Buyers

This bill is good news for people looking to buy a home in Florida. Here’s what it means for you:

- You’ll get more information about flood risks before you buy a house.

- The seller must tell you if the house has ever had flood damage.

- You’ll know if the house is in a flood zone.

- The seller has to share if they have flood insurance.

This information can help you make a smarter choice when buying a home.

For Sellers

If you’re selling a house in Florida, this bill means you’ll need to do a few new things:

- You must tell buyers about any past flood damage to the house.

- You have to share if the house is in a flood zone.

- You need to let buyers know if you have flood insurance.

- You must give this information to buyers before they sign a contract.

These new rules mean you’ll need to be more open about flood risks when selling your home.

Sep 27, 2024

Invitation Homes, the largest U.S. single-family rental landlord, settled a $48 million case with the FTC over allegations of deceptive practices, including hidden fees, unfair eviction policies, and improperly withholding security deposits. The settlement, aimed at refunding harmed renters, requires the company to improve transparency in lease pricing and security deposit handling. The FTC alleged Invitation Homes overcharged renters with undisclosed fees and engaged in unfair eviction practices during the COVID-19 pandemic. Despite the settlement, Invitation Homes maintains it committed no wrongdoing and continues to focus on improving customer experiences. This case highlights growing scrutiny of corporate landlords amid rising housing costs.

Sep 25, 2024

Miami is experiencing a surge in supertall skyscraper development, with seven towers over 984 feet high under construction, marking a historic first for the city. The Waldorf Astoria Hotel and Residences Miami, at 1,049 feet, is the furthest along, driven by an influx of wealth and companies into South Florida. Despite environmental and geographic challenges, such as limestone terrain, high water tables, and FAA height restrictions, developers are eager to capitalize on the booming real estate market. The concentration of supertall projects within a small area could transform Miami’s skyline, rivaling New York and Chicago in height. However, the complexities of building on unstable ground and preparing for storms make these projects particularly costly and difficult.

Sep 12, 2024

Invitation Homes, the largest single-family home landlord in the U.S., reported over $200 million in investment activity in the third quarter of 2024. The company entered agreements to acquire 580 homes in Tampa, Denver, and the Carolinas, most of which were already completed. The acquisitions underscore the company’s strong relationships with homebuilders, as it continues to grow its build-to-rent portfolio, with plans to invest $1 billion in home purchases in 2024. Additionally, Invitation Homes secured a new $3.5 billion credit facility to refinance previous debt at a lower interest rate. Despite potential slowdowns in build-to-rent construction, Invitation Homes sees ongoing demand in its markets, driven by a lack of housing supply.