Nov 7, 2023

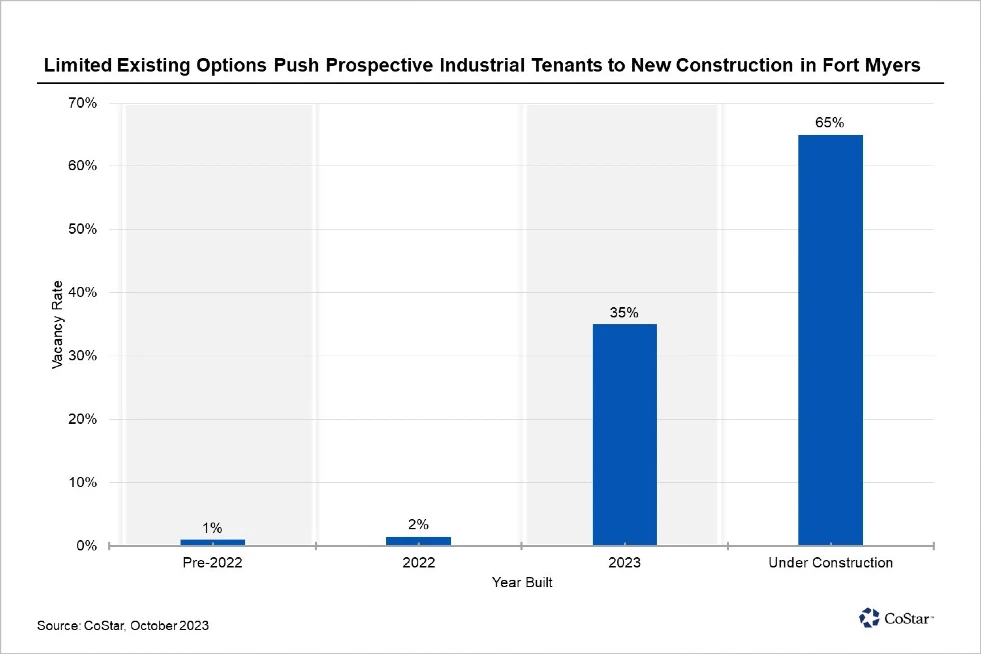

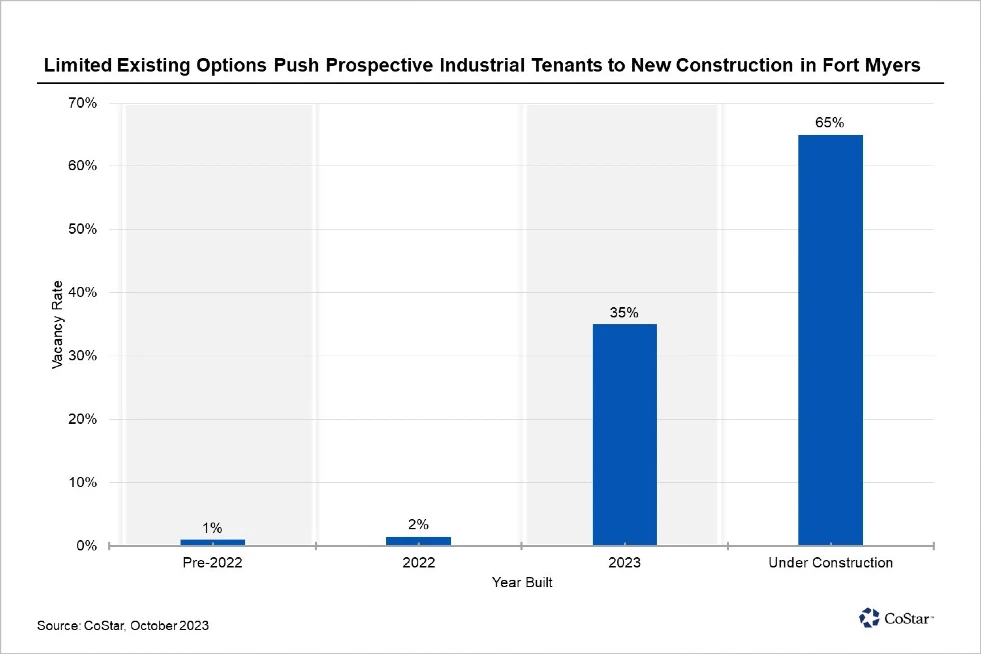

Fort Myers, in Southwest Florida, has seen significant activity in new industrial development with 3.9 million square feet currently under construction, following the completion of 1.4 million square feet. However, recent completions have surpassed tenant move-ins, leading to a slight increase in vacancy rates to 2.4%, marking the first time the vacancy rate has averaged over 2% in a year. It’s projected that the vacancy rate will continue to rise, potentially peaking at around 6% by the end of 2024. Despite this increase, Fort Myers remains a desirable industrial market with strong tenant interest, particularly for spaces under 50,000 square feet. Vacancy is expected to normalize to 2% to 3% in the long term.

Nov 1, 2023

Hotels are increasingly offering a range of amenities and services to pamper pet owners and their pet companions. These services go beyond the traditional water bowls and plush beds, with offerings such as nutritious, fresh dog food in hotel restaurants, “Yappy” hours, play areas, dog mini poolside cabanas, and even doggie turn-down service. Some hotels have specific pet packages, including access to telehealth appointments for pets and dedicated pet concierges, catering to both traditional and non-typical emotional support animals and exotic pets. These pet-friendly amenities aim to enhance the guest experience for pet owners and their beloved animals while contributing to a more comfortable environment for all guests.

Oct 31, 2023

13th Floor Homes has initiated the construction of Marina Landings, a luxury gated community in Fort Lauderdale, Florida, featuring 34 single-family homes. The project addresses the challenge of scarce available land in South Florida by repurposing infill sites. The development, located near the airport and downtown, offers homes starting in the low 1-millions, with various floor plans, and is expected to be completed in 2024. The demand for single-family homes in the region has led the company to expand its presence into various Florida submarkets.

Oct 28, 2023

Invitation Homes, the largest owner of single-family rentals in the US with around 85,000 properties, is facing challenges in finding properties to purchase. Despite a strong demand for rental homes, the company struggles to acquire suitable properties, often getting outbid when they do find something that fits their criteria. They are turning to homebuilders to strengthen their portfolio and have formed partnerships with them to build new homes. Invitation Homes reported revenues of $618 million in the third quarter, with a robust leasing market and rents returning to historical norms. They are also selling older, non-core properties to fund new acquisitions, with a construction pipeline of 1,931 homes in partnership with third-party builders. The company is well-positioned with ample liquidity for potential merger and acquisition deals in the future.