Jan 6, 2024

In November, U.S. companies announced a total of 45,510 job cuts, marking a 24% increase from the previous month. Despite being 41% lower than the same period the previous year, the year-to-date job cuts in 2023 were more than double the figure for the first 11 months of 2022, totaling 686,860. The technology industry led in announced job cuts for the year, with 163,562, including 5,049 in November. Additionally, the House Energy and Commerce Committee advanced a bill to address the shortage of electrical distribution transformers, while jobless claims increased by 1,000 to 220,000 for the week ending December 2, indicating a tightening job market.

Dec 26, 2023

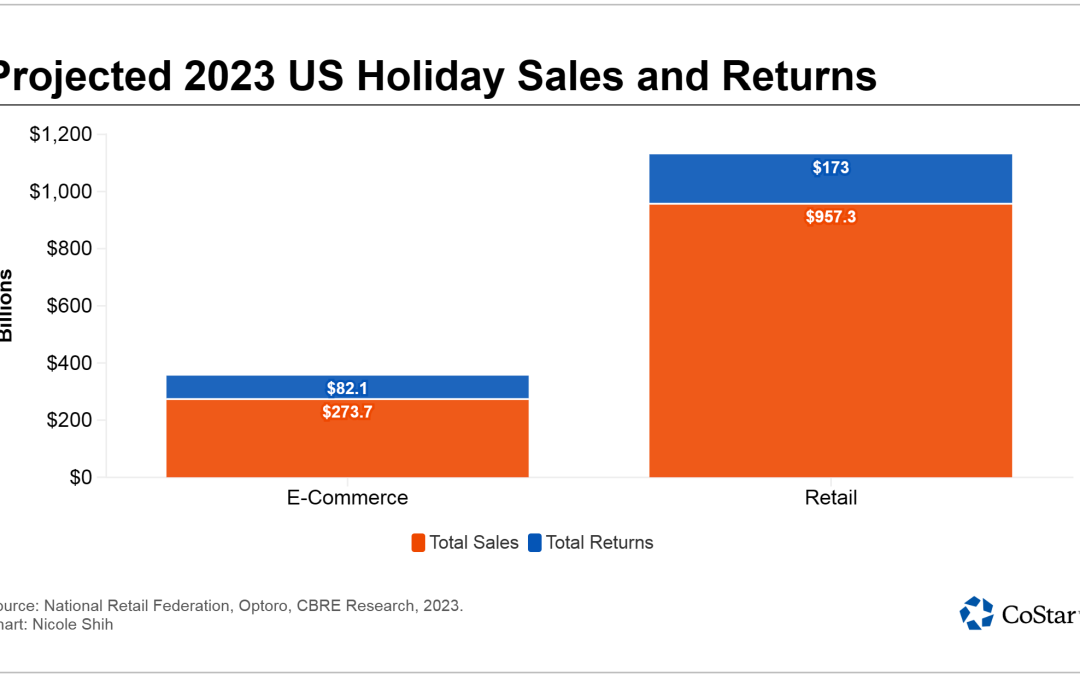

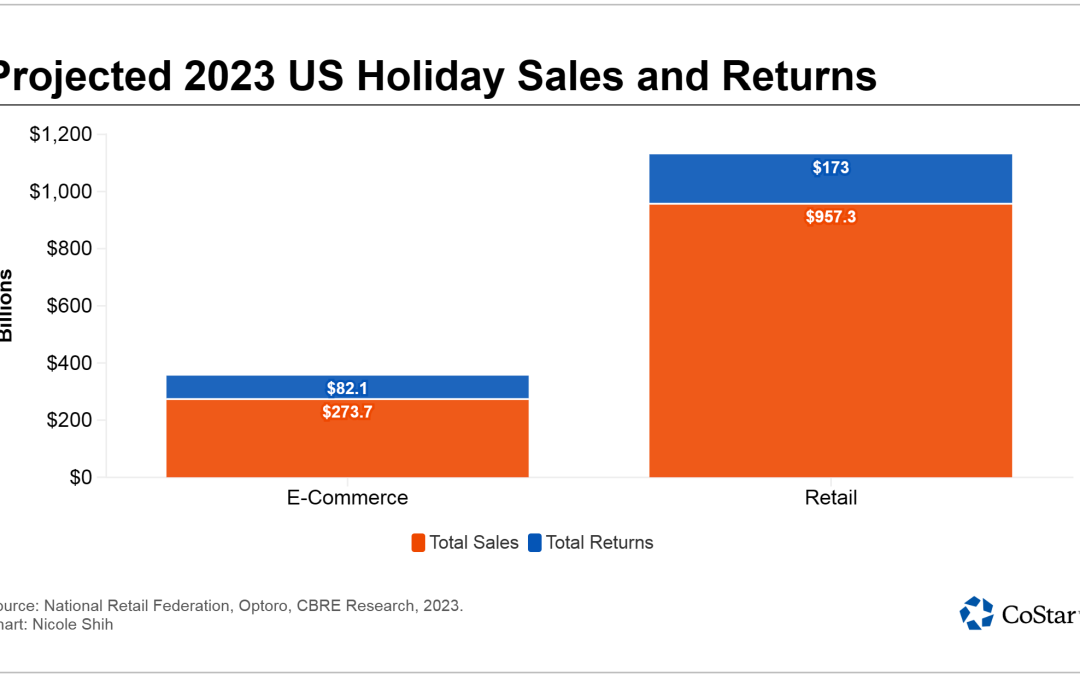

Holiday gift returns have become a significant driver for the third-party logistics industry, with these providers representing nearly 31% of all industrial leases of 100,000 square feet or more in the first three quarters of the year. In the past four years, third-party logistics providers, many of which provide reverse logistics services, have leased more than 100 million square feet of bulk warehouse space annually, according to CBRE.

The growth in e-commerce, expected to account for over 30% of sales by 2030, contributes to the increasing demand for reverse logistics services and the associated real estate. Additionally, some retailers are adopting strategies such as charging return fees and implementing shorter return windows to mitigate excessive returns, with technology and strategic approaches seen as opportunities to turn returns into a revenue-generating aspect of retail.

Dec 19, 2023

Multifamily rent growth experienced a significant acceleration in 2021 and early 2022, leading to concerns about affordability and calls for rent control. However, since late 2022, the growth has slowed, and in some major markets, rents have even declined. On a national level, the average asking multifamily rent is only $65 higher than it would have been with pre-pandemic growth rates. Markets in Florida, particularly Palm Beach, show the largest positive differences, with rents significantly higher than projected. In contrast, several large coastal California markets, including San Francisco, San Jose, and East Bay, have lower rents than anticipated. The variations are more pronounced between different property types, with four- and five-star properties experiencing the greatest absolute differences. Miami and Orange County have notably higher rents for high-end properties, while San Francisco’s most expensive units are cheaper. Lower-priced one- and two-star properties generally have marginal increases, with some renter households paying slightly less than anticipated in a few markets. Bay Area markets stand out for lower rents in one- and two-star properties compared to pre-pandemic projections, while Palm Beach has higher rents in this category.

Dec 19, 2023

After nearly two years of delays, El Salvador’s Bitcoin Volcano Bond has received regulatory approval from the Digital Assets Commission (CNAD) and is expected to be issued in the first quarter of 2024. The bond, named after a plan to use geothermal energy from a volcano for Bitcoin mining, was initially announced by President Nayib Bukele in 2021 after El Salvador adopted Bitcoin as legal tender. The bond’s debut in early 2022 was postponed and faced multiple delays before El Salvador’s congress passed a law in January, creating a legal framework for the bond. The bond could help the nation avoid defaulting on its debt, although the International Monetary Fund has urged El Salvador to eliminate Bitcoin as a legal currency. The funds raised by the Volcano Bond are intended for the creation of a “Bitcoin city” and investments in Bitcoin itself, aligning with El Salvador’s broader embrace of cryptocurrency.

Dec 13, 2023

In November, the number of distressed office properties backed by commercial mortgage-backed securities loans increased by 1.1%, reaching a total of 762 buildings, with a 30% vacancy rate. The distress level may improve as some properties recently received loan modifications. Notable among these is a portfolio of nearly 150 properties in Pennsylvania, securing a $1.27 billion loan, set to be removed from special servicing after a two-year loan extension by Workspace Property Trust. In downtown Philadelphia, the servicer deemed a $126 million loan on the Wanamaker Building nonrecoverable, with an updated appraised value 71.8% below the 2018 value.

Additionally, final offers are being reviewed for the Countryside Mall in Clearwater, Florida, which faced credit rating downgrades, leading to potential losses in a CMBS deal. The 1.4 million-square-foot mall, managed by special servicer Midland Loan Services, was transferred to special servicing in June 2020. JLL is overseeing leasing and management, and while the mall’s value has risen, a pending transaction is under review for approval.